Demystifying the Medical Information Bureau

Considering purchasing life insurance but feeling overwhelmed by the process? Understanding the role of the life insurance Medical Information Bureau can demystify some of the complexities involved. An understanding of how the information bureau operates can help you navigate the life insurance application process with greater clarity and confidence.

This article provides critical insight into information about the Medical Information Bureau (MIB) and how the data provided can impact your life insurance application, underwriting requirements, and potentially policy approval.

What is the purpose of the MIB?

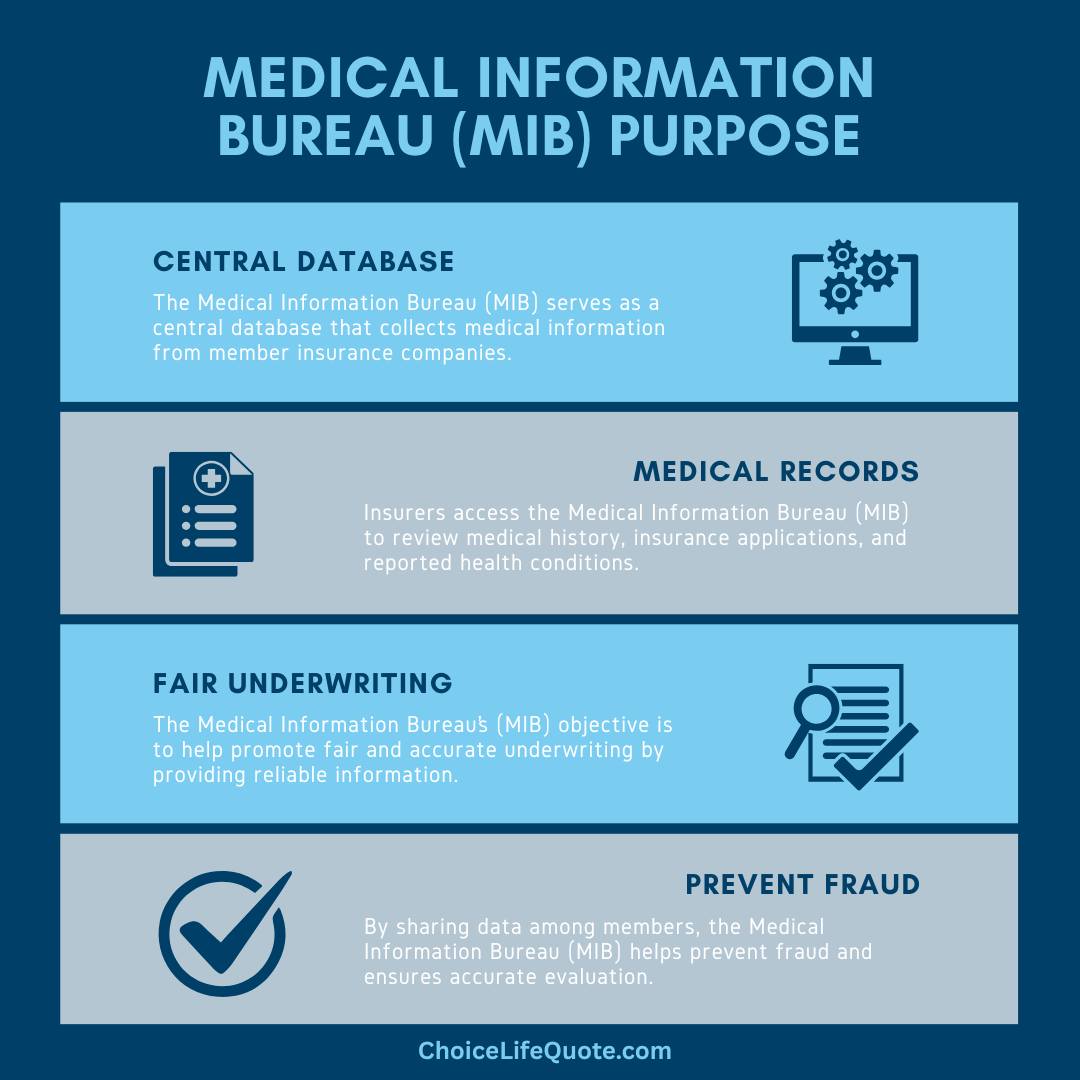

The MIB serves as a central database that collects and stores medical information from insurance company applications and the insurance medical underwriting processes and procedures overall.

Its purpose is to provide crucial information to insurance companies in assessing an individual’s risk profile and fairly underwriting life insurance policies.

When you apply for life insurance, the insurer may request access to your MIB file to review your medical history, previous insurance applications, and any reported health conditions. The MIB’s mission is to promote fair and accurate underwriting by providing insurers with reliable information. By sharing data among member companies, the MIB helps prevent fraud and ensures that individuals are accurately assessed for risk.

However, it’s important to note that the MIB is not a medical or insurance provider. It is simply a reporting agency that helps insurers make informed decisions about an applicant's overall health and risk based on aggregated data.

How the MIB Process Works

The MIB operates by collecting and storing medical information from insurance applications submitted by individuals. In order to have an active MIB file a consumer must have applied for insurance from an MIB member company. When you apply for life insurance, the insurer may request your consent to access your MIB file. If you provide consent, the insurer can request relevant information from the MIB to help assess your risk and determine insurability.

The MIB collects information such as previous insurance applications, reported health conditions, and medical history. This data is shared among MIB member companies, allowing insurers to make more informed decisions during the underwriting process. It’s important to understand that the MIB does not make decisions regarding your life insurance application. Instead, it provides insurers with information to help them assess your risk and determine your policy’s terms.

Information the MIB Collects

The MIB collects and shares information related to insurance applications, medical history, previous insurance applications, and reported health conditions. It does not have access to complete medical records or ongoing medical treatments. The information collected by the MIB is used to provide insurers with relevant data to assess risk and determine policy terms.

The MIB operates under strict privacy and security protocols. It ensures that your personal information remains confidential and protected within its secure database. The MIB’s primary goal is to provide accurate and reliable information to insurers while maintaining the privacy and security of individuals’ data.

Why Companies Use the MIB

Life insurance companies use the MIB to obtain accurate and reliable information to assess an individual’s risk profile. By accessing an applicant’s MIB file, insurers can review their medical history, previous insurance applications, and reported health conditions. This information helps insurers make more informed decisions during the underwriting process.

Using the MIB allows insurers to identify any discrepancies or potential misrepresentations made by applicants. It helps prevent fraud and ensures that policyholders are accurately assessed for risk. By using the MIB, insurers can make fair and accurate underwriting decisions, which ultimately benefits both the insurer and the policyholder.

How the MIB Impacts Applications

The MIB can have an impact on your life insurance application in several ways. When you apply for life insurance, the insurer may request access to your MIB file.

This allows them to review your medical history, previous insurance applications, and any reported health conditions. The information provided by the MIB helps the insurer assess your risk and eligibility.

The information provided by the MIB helps the insurer assess your risk and determine your policy’s terms. If the information in your MIB file raises concerns for the insurer, they may request additional medical information or ask you to undergo a medical examination. This is done to gather more information and ensure an accurate assessment of your risk. The MIB’s role is to provide insurers with the necessary data to make informed decisions during the underwriting process.

It’s important to be truthful and accurate in your life insurance application. Misrepresenting information or omitting relevant details can lead to complications and potential denial of coverage. The MIB helps insurers verify the accuracy of the information provided in your application, so it’s essential to be transparent and thorough.

Impact of the MIB on Underwriting

The MIB can play a significant role in the underwriting and pricing of life insurance policies. By providing insurers with accurate and reliable information, the MIB helps ensure that policyholders are assessed for risk accurately. This allows insurers to determine appropriate policy terms and premiums based on an individual’s risk profile.

Insurers use the information provided by the MIB to assess an applicant’s risk and determine whether to offer coverage. The MIB’s data helps insurers identify any potential red flags or discrepancies in an applicant’s medical history or previous insurance applications. This information allows insurers to make informed decisions during the underwriting process.

How to Access Your MIB File

As an individual, you have the right to access your MIB file. If you want to review the information held by the MIB, you can request a copy of your file directly. The process for accessing your MIB file may vary depending on your location and current regulations.

To request your MIB file, you will need to provide certain identification documents and complete the necessary forms. The MIB will review your request and if approved provide you with a copy of your personal file. Reviewing your MIB file can help you understand the information insurers have access to when assessing your life insurance application. A record request may be initiated through the links to the MIB resources provided below, or by visiting the website directly at https://www.mib.com/request_your_record.html.

Conclusion

In conclusion, the MIB's role in underwriting and pricing helps maintain fairness and accuracy in the life insurance industry. By using reliable data, insurers can offer coverage to individuals at appropriate premiums based on their risk profile. This benefits both insurers and policyholders by ensuring fair and accurate life insurance policy pricing.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your individual situation. Get quality coverage at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.